Investing doesn’t have to be difficult. In fact, it shouldn’t be difficult. This guide shares concrete strategies to make investing easy and effective. Save your energy for working hard and advancing your career. Let your money work for you.

Why invest?

If you’re already convinced you should be investing, it’s safe to skip this section. If you’re still on the fence, here are some great reasons.

- The power of compound interest: Whether or not Einstein called compound interest the “8th wonder of the world,” it’s pretty remarkable. The idea is simply that you earn interest on interest, meaning that your money grows at faster and faster rates. Check out how the curves below become steeper over time. Just $6,000 a year starting in your 20s can make you a multimillionaire in retirement.

- It’s very easy: This guide will show you how to start investing today. Once you determine your basic strategy and set up your accounts, you only need to actually log in or do anything a few times a year.

- Anyone can do it: Investing used to be pretty tough. There were high fees and it was difficult to get updated information about the market. Nowadays, the fees are gone, you can access your accounts on your phone, and you can get started with as little as $5.

- It’s best to start as early as possible: At an average rate of return of 7%, every dollar you invest at age 18 would grow by almost 9x by the time you’re 50. If you wait until you’re 30, the multiplier is only 5x. As a young investor, time is on your side!

- A savings account is one of the worst places to store your money: This is due to inflation, the fact that prices tend to rise over time. As prices rise, your money becomes less valuable. If your money isn’t growing to match the inflation rate, you’re actually becoming poorer without even realizing. Savings accounts offer notoriously low interest rates, typically well below the inflation rate.

Bottom line:

- It’s the most straightforward path to wealth: Consistently investing in the broader market over a long time span (20+ years) is proven to make you rich. Don’t just take my word for it. You can try a calculator here, or access the raw data and do your own analysis.

Who this guide is for:

While everyone should learn how to invest and grow their wealth over time, sometimes it makes sense to put your money in other places first. Follow this guide if you can say yes to the following:

- You already have an emergency fund: It’s recommended to keep 3-6 months of living expenses easily accessible, i.e. in a bank account. This should cover your expected costs for things like food and rent. If your refrigerator breaks or you lose your job, your emergency fund will help you get back on your feet.

- You don’t have immediate savings goals: If you’re planning on a big purchase in the near future, like a car or house, it probably makes sense to save for that instead.

- You don’t have high-interest debt: If you have credit card debt, or any other debt with a high interest rate, you typically should focus on paying it off before investing.

To stay organized, this guide consists of two sections: the basic steps and the fundamental ideas. The basic steps are exactly what they sound like. They’re the specific actions involved in setting up your account and buying your first investments. The fundamental ideas are the concepts that create truly effective investors. Because they’re so important, we’ll tackle the fundamental ideas first.

The fundamental ideas:

Choose a savings rate you will stick to:

Just like dieting, the most successful plans are the ones you actually continue. Though you want your savings rate to be as high as possible, sticking with your plan is even more important than the rate itself. Aim for a minimum of 15% of your pre-tax salary. This will be enough to ensure a healthy income in a standard retirement. If you’re interested in retiring early or becoming financially independent, you need to save aggressively. A savings rate closer to 50%, or even higher, will allow you to hit those goals. If saving 15% seems impossible for you, it’s ok. DON’T let it prevent you from investing. A rate of 5% or even 1% is better than nothing. As you start earning more, raise your rate.

Put your money in the right place:

There are some places that are great for storing money, and some that are terrible. The two main things to consider are the expected rate of return, and the tax advantages. Long-term investing in the stock market takes care of the first one. Choosing the right accounts in which to store your investments covers the second. If you don’t already have one, your first investing account should be an IRA (Individual Retirement Account). There are two types of IRAs, Traditional and Roth, which both offer remarkable tax advantages.

- In a Traditional IRA, you contribute pre-tax money, meaning that you pay zero taxes on the money you deposit. You’re only taxed when you take money out, after it has grown. These benefits come at the cost of flexibility: withdrawing money before age 59½ comes with a 10% penalty.

- In a Roth IRA, you contribute money after you’ve been taxed on it, but then pay zero taxes on the money ever again, even when you withdraw after it has grown. Additionally, a Roth IRA lets you withdraw your contributions anytime, tax and penalty free. Because of this, the Roth option is the most flexible.

| Roth IRA | Traditional IRA | |

| Contributions | After-tax (not tax deductible) | Pre-tax (tax deductible) |

| Withdrawals | Contributions: Tax and penalty free Earnings: Taxable + 10% penalty (if before age 59½) | Taxable + 10% penalty (if before age 59½) |

Choosing which type is best for you can be complicated. There’s no single option that’s right for everyone because the choice depends on specific details like your income, your tax rate now, your expected tax rate in retirement, and more. We highly suggest taking the time to understand the basics of each and make an informed decision. The main concepts behind the two types are easy to grasp, but both options have many technicalities that can be confusing. If you’re struggling to come to a conclusion, just pick one and go for it. There’s no rule saying you can only pick one. You’re allowed to change your mind, and can contribute to both types of accounts at the same time. Under certain circumstances, you can even convert one type into the other. It’s more important to begin the habits of saving and investing than it is to choose the optimal IRA type for your first early contributions.

In most states, you have to be at least 18 to open the account for yourself. (If you’re younger, ask your parents/guardian about setting up a custodial account for you.) You can contribute up to $6,000 annually (total across both types of accounts), as long as it’s money you actually earned during the year. If you didn’t have a job or other source of income, you can’t contribute.

If you have a job with retirement/health benefits:

Your job may offer plans like a 401(k) and HSA (Health Savings Account).

- The 401(k) is a critical tool for effective investing. Just like IRAs, a 401(k) is available in both Traditional and Roth flavors. The key idea behind a 401(k) is that money is contributed to the account directly from your paycheck. Additionally, the contribution limit is much higher than an IRA, currently at $19,500 annually. Since $6,000 a year can already make you a millionaire, just imagine what 3x times that can do!

Pro tip: If your job’s 401(k) offers any matching, take it! It’s literally free money. In most cases, an employer will match your own contributions up to a limit. They do this because they get to deduct the matches from their own corporate taxes, and it’s a great benefit for retaining talent. If you don’t contribute at least up to the match limit, you’re leaving free money on the table.

- HSAs are designed to help you save money on healthcare, but don’t let the “H” in HSA fool you. When used effectively, it can be one of the most powerful retirement savings tools. Why? Because the money you put in is literally never taxed. Contributions are tax free, capital gains are tax free, and withdrawals are tax free. It’s a triple-threat tax savings opportunity you can’t pass up. Not every job (or insurance plan) offers these accounts, but if you’re eligible for one, make sure to take advantage of it.

Note: The accounts described above, IRA, 401(k), and HSA are simply places in which to store your investments. Just because you opened an account and contributed money doesn’t mean it will grow automatically. You need to actually buy assets (like stocks and bonds) inside the account for your money to grow. Additionally, if you’re sold on the idea of long-term investing, but don’t have the time or confidence to do it yourself, there are services that will do it all for you. They’re called automatic investment services, or robo-advisers. Though they won’t help you pick winning investments better than any other adviser, they can be helpful in organizing your finances. Just beware they charge fees for their service and everything in this guide can be done for free on your own.

Invest for the long haul:

Consider the money you invest as money you won’t access for 20+ years. Your investments should be a one-way street, i.e. contributions only. There are a few reasons for this. One is that many of the best tax-advantaged accounts force you to pay a steep financial penalty if you take the money out before the age of 59 and a half. Second, more time investing means more time to grow. Third, more time means more opportunities to recover from any market dips. Patience is one of the most important virtues for long-term investing.

Invest, don’t speculate:

Unless you do extensive analysis of a company and its industry, purchasing particular stocks is not too different from gambling. There are so many factors that affect a stock price, and absolutely zero of them are in your control. The only thing you can be sure of is that the entire market as a whole will rise in the long-term. Everyone has theories about why a specific stock is a winner or loser. It’s easy to get swept up into trends, or feel like a company you admire is a safe bet. This is dangerous thinking. One of the largest stock brokers once performed an analysis to see which clients were the most successful stock pickers. They found that the people with the best performance were ones who literally forgot they even had an account. Let that sink in. The people who spent zero time researching, zero time making decisions, and zero time worrying about their portfolio did the best. It’s better for your mental health and your wallet to avoid guessing about the markets.

Rely on strategy, not opinion:

- Fact #1: You don’t know more about the market than the experts

- Fact #2: The experts don’t know much about the market either

The sooner you recognize these two facts, the stronger investor you will become. There are millions of financial and investing professionals who do their best to choose winning stocks. They use complex models, have access to immense amounts of real-time data, and spend most of their time analyzing the markets. It can be tempting to buy funds that let these experts manage your investments for you. After all, they’re the experts. Unfortunately, even with maximum resources and time, the majority of professionals fail to beat the market consistently. The worst part? They charge high fees for their services. Don’t do it.

Buy the entire market:

This is the only strategy that minimizes risks and fees while maximizing long-term gains. This concept is called passive investing. If it sounds boring, that’s because it is. Since you’re investing in the market as a whole, you don’t have to do any research or make any guesses on which stocks are going to do well. Passive investing relies on a concept called an index. Indexes are statistical measures of the market (or subset of the market) that allow investors to compare historical prices and analyze market performance. One of the most popular indexes is called the S&P 500. It’s an index of the 500 largest public companies in the United States. Its value is essentially the sum of all those stock prices, weighted by how big the company is.

Because an index is basically just a number, you can’t buy an index directly. Fortunately, there are financial products that directly track indexes, allowing you to own little pieces of everything in the index. These are called index mutual funds and index ETFs (exchange traded funds). For the purpose of long-term investing, they are almost identical. The main difference is that ETFs function like individual stocks and can be bought and sold throughout the trading day, whereas trading a mutual fund only happens at the end of the day. Buying the whole market in this way is stable because of the diversity. If something catastrophic happens to a specific company, it will have a minimal effect on your holdings. When you invest in the entire market, you’re investing in tech, manufacturing, energy, healthcare, retail, and more, all in one go.

Annual Return of the S&P 500 Since 1928

The graphic above demonstrates the volatility of the market and the importance of buying and holding for the long-term. Any given year is typically very far from average. It’s only over a long period of time that returns even out to ~7% average after inflation. (Source: Macrotrends.net)

Don’t let other people profit from your money:

One of the best features of index mutual funds and ETFs is that because they simply track an index, a computer does all the work. With no expensive fund managers and analysts to pay for their time and research, index funds and ETFs have the lowest possible fees. In the long-term, even a difference of 0.1% can end up costing you large amounts of growth. The main takeaway here is to avoid paying for things you don’t need. You don’t need to pay for the fancy financial product or special advisor, especially when more often than not, the market itself beats most pros.

Do NOT sell if the market goes down:

This only serves to lock in your losses when dips happen. The market WILL go down at some point. Investing is not about avoiding crashes, it’s about staying smart when they occur. Even though it’s scary, a crash in the market is the perfect opportunity to buy stocks on the cheap. By definition, the most growth happens after a crash. Stay confident and stick to your strategy. Warren Buffett, the most successful investor of all time, sums up this concept in a famous quote: it’s wise to be “fearful when others are greedy, and greedy when others are fearful.” Following this advice will prevent you from getting caught up in fads and will ensure you take advantage of market dips.

Start now:

Even by following this guide, there are still a lot of choices you need to make. Things like savings rate, Roth v.s. Traditional, asset allocation, and more. Don’t let the complexity of making these decisions deter you from starting as soon as possible. In many cases, there is no “perfect” choice. Additionally, you’re not locked into any of these choices. Starting early means you have more time to research and make better decisions as you go. Start investing today! Your future self will be glad you did.

The basic steps:

Open an account and deposit money

- Any of the large brokers will largely be the same, so don’t worry too much about which one you choose. They all offer IRAs, free trades, mobile apps, and low-fee index mutual funds and ETFs. Do some research and just pick one. It’s possible to switch later if you feel a different one is a better fit.

- Add a bank account to deposit money. If you think remembering to stick with a consistent contribution schedule will be difficult, you can enable auto-deposits and auto-investing. If you can, make it a habit to invest some of every paycheck.

Purchase investments

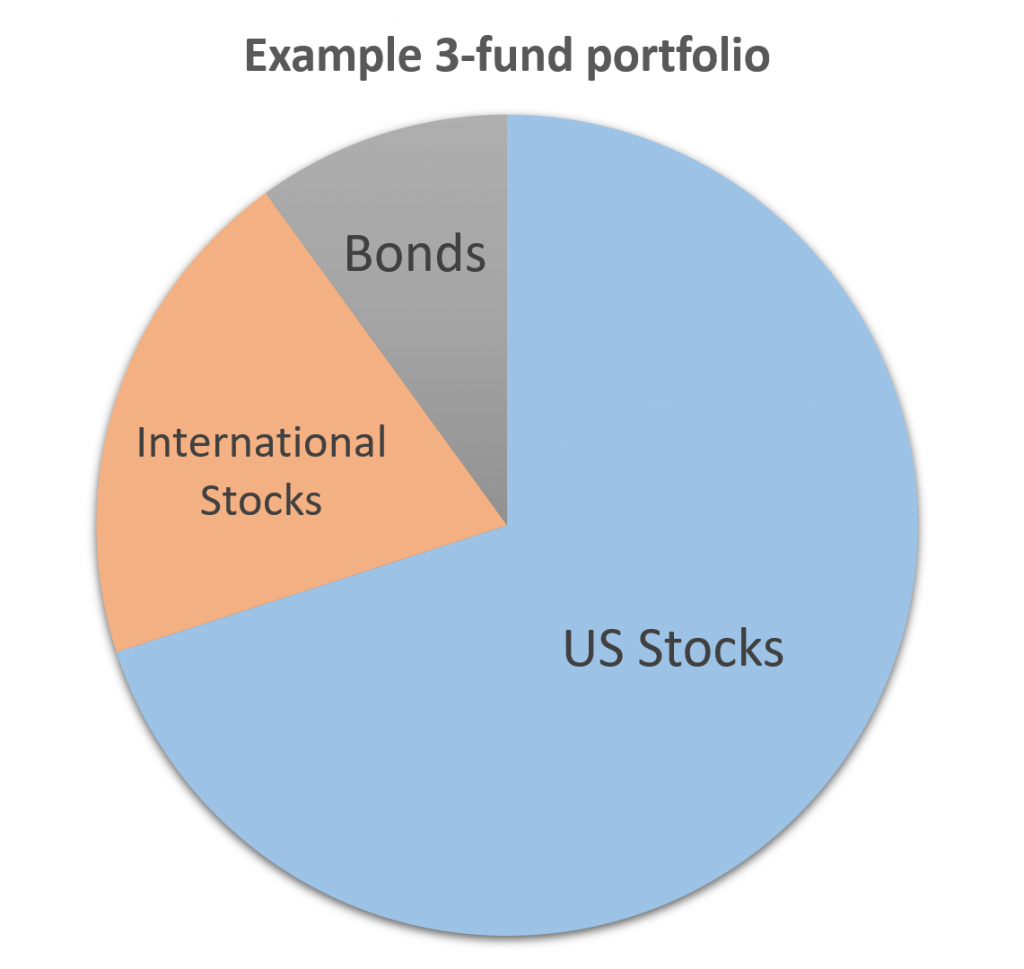

Ok, so you’ve opened a tax-advantaged account and deposited money. Now what do you buy? Everyone has a different opinion on this, so it’s good to do your own research. One popular method is called the lazy, or three-fund portfolio. It offers solid returns at minimal risk and is dead simple.

- One total US stock market index fund/ETF

- One total international (excluding US) market index fund/ETF

- One total bond market index fund/ETF (If you have no idea what a bond is or why you’d invest in them, you can read more here.)

Note: Each broker typically offers its own selection of whole-market, or S&P 500 ETFs/funds. Because they’re all tracking the same indexes, it’s usually best to choose the one with the lowest fee.

The next question is: how much of each? This is called asset allocation, a financial term for what percentage of different types of assets are in your portfolio. A common rule of thumb is holding 110 – your age in stocks. E.g. if you’re 25 years old, you’d hold 110 – 25 = 85% in stocks and 15% in bonds. The point of this calculation is to gradually ease you into holding more bonds as you grow older. This is because bonds are generally much safer investments and are often uncorrelated or even inversely correlated with the stock market.

However, that safety comes at a price: Bonds grow much slower than the stock market. As you get close to retirement age, it’s more important to retain your wealth than to grow it, i.e. you should hold more bonds. When you’re young, and have a long time before you need to take your money out, you want to focus on growth. As a young investor, it’s ok if the stock market crashes. In fact, that’s the perfect time to buy more stocks at a discount!

But if you’re only a few years from retirement and the stock market crashes, you are going to be disappointed you didn’t have more bonds to keep things stable. Though the above calculation is very simple, it’s not for everyone. Many young investors choose to hold few, if any, bonds until they are a bit older. It’s important to do your own research to find a strategy you’re comfortable with.

How much international: The question of how much of the US market to hold versus how much of the international market is similar. There is no one right answer! Many investors stick to simple allocations like 70% US and 30% international, or 80/20 or 60/40. Either way, you’re probably going to want more US than international. This is because major American companies are some of the biggest in the world and already have large international exposure.

Rinse and Repeat:

Contributing on a consistent basis for a long time period is really all there is to it! The only other thing to know is that occasionally you should rebalance your portfolio. This means buying and selling your investments until they match your intended asset allocation. For example, if your US stock market investments grow more than your international holdings, they are going to take up a higher percentage of your portfolio. You can buy a bit more international investments, or sell a few US investments to even them out again. Don’t worry about doing this all the time. It’s perfectly ok to do this once every six months, or even once a year! Research has shown how often you rebalance doesn’t matter too much. It’s much more important to stick to your savings rate and keep buying the market.

Bottom line:

- Start early: The sooner you start investing, the more your money will grow. Because of the nature of compound interest, starting early can make a HUGE difference.

- Invest as much as you can: Investing small amounts of money is good for getting familiar with the process, but it won’t support you much later in life. Aim to hit 15% or more of your gross income. The strongest indicator of your future financial independence is not your salary but your savings rate

- Keep it simple: Choose a basic asset allocation with only 2-4 holdings. Make sure those investments have low fees, preferably less than 0.1%.

- Don’t stop: Keep contributing consistently. Make it a habit. Every pay day, invest more money. Just like you pay rent or a mortgage to ensure you have housing, you invest each month to ensure you have a bright financial future.